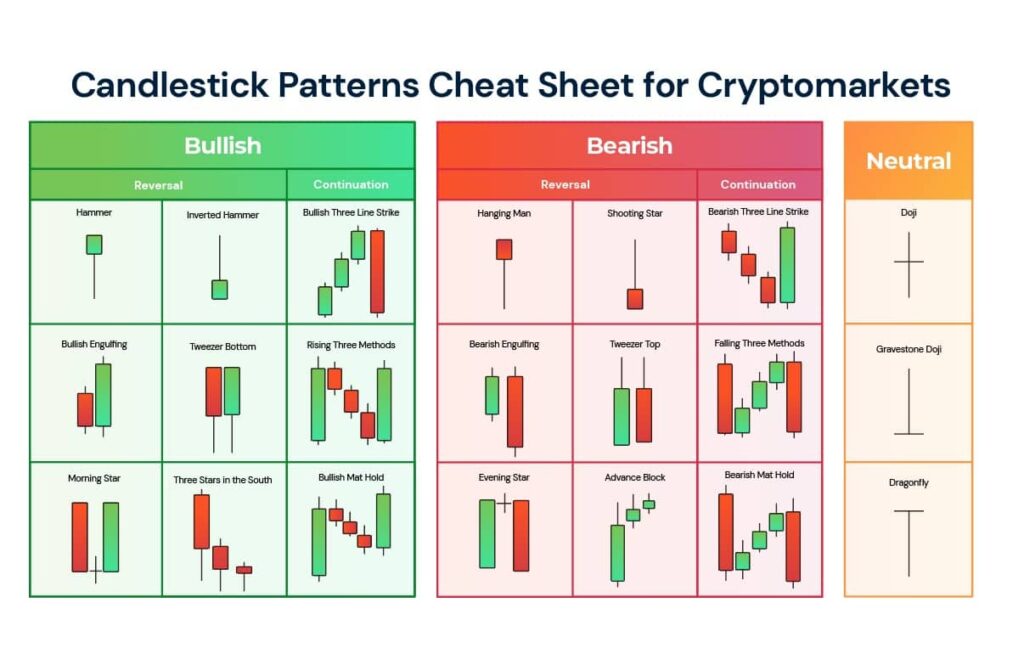

Candlestick patterns are pivotal in technical analysis, offering insights into market sentiment and potential price movements. Understanding these patterns empowers traders to make informed decisions and effectively navigate volatile markets. Discover expert insights on mastering essential candlestick patterns with Immediate Catalyst, your gateway to trader education and insights.

1. Doji Candlestick Pattern

The Doji candlestick pattern is a crucial indicator in technical analysis, characterized by its open and close prices being virtually equal, resulting in a very small or non-existent body.

This pattern suggests market indecision and potential reversal points. Variations such as the Long-legged Doji, Gravestone Doji, and Dragonfly Doji provide further insights into market sentiment.

Traders interpret a Doji depending on its location within a trend and its formation in relation to adjacent candles. For instance, a Doji appearing after a long uptrend might signal exhaustion among buyers, potentially indicating a trend reversal or consolidation phase. Conversely, a Doji following a downtrend could imply seller indecision and a potential price bottom.

Successful trading with Doji patterns involves confirmation from other technical indicators or candlestick patterns to validate potential signals. Traders often use Doji patterns in conjunction with trendlines, support, and resistance levels for enhanced decision-making.

2. Hammer and Hanging Man Candlestick Patterns

The Hammer and Hanging Man patterns are notable for their distinct shapes and implications for market sentiment. The Hammer pattern forms at the end of a downtrend and consists of a small body at the upper end of the trading range with a long lower shadow, resembling a hammer. This pattern suggests potential reversal of the downtrend, as buyers have managed to push prices higher from the lows.

Conversely, the Hanging Man pattern appears at the end of an uptrend, characterized by a small body near the top of the trading range with a long lower shadow. This pattern signals potential weakness in the uptrend and a possible reversal, as sellers may be gaining strength despite the attempt to push prices higher.

Traders often wait for confirmation signals such as a bullish or bearish candlestick pattern the next day or increased trading volume before making trading decisions based on Hammer and Hanging Man patterns. These patterns are effective when combined with other technical indicators and price action analysis.

3. Engulfing Candlestick Patterns

Engulfing patterns, consisting of Bullish and Bearish Engulfing patterns, are significant signals for trend reversal. The Bullish Engulfing pattern forms when a large bullish candle completely engulfs the previous smaller bearish candle, indicating a shift from selling to buying pressure and potential upward movement in price.

Traders often look for Engulfing patterns at key support or resistance levels and combine them with other technical indicators such as moving averages or trendlines for confirmation. The effectiveness of Engulfing patterns lies in their ability to provide clear visual signals of changes in market sentiment and potential entry or exit points for trades.

Engulfing patterns are versatile and can be applied to various timeframes, from intraday trading to long-term investing strategies. Successful trading with Engulfing patterns requires patience and confirmation to avoid false signals and maximize profitability.

4. Morning Star and Evening Star Candlestick Patterns

Morning Star and Evening Star patterns are powerful indicators of trend reversals, commonly found at the end of uptrends (Morning Star) or downtrends (Evening Star). The Morning Star pattern consists of three candles: a large bearish candle, followed by a small bullish or bearish candle with a gap down, and finally, a large bullish candle that closes within the first candle’s body.

Conversely, the Evening Star pattern forms with a large bullish candle, followed by a small bearish or bullish candle with a gap up, and then a large bearish candle that closes within the body of the first candle. This pattern indicates that buyers are losing momentum, and sellers may be gaining control, potentially signaling a reversal to a downtrend.

Traders often wait for confirmation signals such as increased trading volume or additional candlestick patterns before acting on Morning Star and Evening Star patterns. These patterns are effective when combined with other technical indicators and fundamental analysis to enhance trading decisions.

5. Harami Candlestick Pattern

The Harami candlestick pattern consists of two candles: a large candle, followed by a smaller candle that is fully contained within the vertical range of the previous candle. This pattern indicates a potential reversal or indecision in the market, depending on whether it is bullish or bearish.

A Bullish Harami pattern forms when the second smaller candle is bullish and appears after a downtrend, suggesting that selling pressure may be weakening and buyers could be entering the market. Conversely, a Bearish Harami pattern occurs when the second smaller candle is bearish and appears after an uptrend, indicating potential exhaustion among buyers and a possible reversal to a downtrend.

Traders often look for confirmation signals such as volume changes or other technical indicators before acting on Harami patterns. These patterns are versatile and can be applied across different timeframes and asset classes, providing clear visual signals of market sentiment shifts and potential entry or exit points for trades.

Conclusion

Mastering these top 5 candlestick patterns—Doji, Hammer and Hanging Man, Engulfing, Morning Star and Evening Star, and Harami—can significantly enhance a trader’s ability to identify trend reversals and entry/exit points. Continual practice and integration of these patterns into trading strategies are key to maximizing profitability and minimizing risks in trading.